straight life annuity with period certain

In this annuity payments are made for a specific period whether or not the annuitant dies. The extract of which can be seen in the below image from Audit Report of Reliance.

Annuity Payout Options Immediate Vs Deferred Annuities

You can manipulate your term from three to 40 years and most are highly flexible.

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

. Because pension plans are intended to provide periodic payments for life certain forms of payment are required by law. For example a fixed-period annuity also called a period-certain annuity guarantees payments to the annuitant for a set length of time such as 10 15 or 20 years. You Could Pay More in Taxes.

In this annuity payments are made for a specific period whether or not the annuitant dies. That income would be below the tax-threshold. If the formula provides 30 per month for each year of service the single.

An annuity is an insurance contract in which you pay a premium to receive regular payments for a specified period of time. Health Insurance Emergency cover for hospitalisation treatment and your recovery. We take an example of Reliance Industries Ltd.

If the annuity holder dies before the end of the period the payments for the rest of that time will go a beneficiary or the annuitants estate. Financial protection for your family if the unexpected happens. Speak with an expert.

The life expectancy tables in Appendix B have been updated to reflect the new life expectancy and distribution period tables in the updated regulations in section 1401a9-9 applicable to distribution calendar years beginning on or after January 1 2022. Straight Line Depreciation Formula Example 2. B Its premium steadily decreases over time in response to its growing cash value.

If you are using funds from your RRSPRRIF in a term-certain annuity payments usually only last until age 90. California residents who interact with DRB Capital may request certain information. Get a 100 gift card with phone every quote.

Reliance uses the Straight Line Method of charging Depreciation for its certain assets from Refining Segment and Petrochemical Segment and SEZ Unit Developer. Term-certain annuities are usually the one I prefer. If you are using funds from your RRSPRRIF in a term-certain annuity payments usually only last until age 90.

Which statement is NOT true regarding a Straight Life policy A It has the lowest annual premium of the three types of Whole Life policies. Adding the period. You can re-invest the monthly annuity income in a retirement annuity and claim a tax deduction up to the permitted limits.

Life annuity with period certain B Increasing term C Limited pay whole life D Interest-sensitive whole life. To be reasonably certain of a sustainable income you draw-down rate should only be around 4 pa R50 000 pa. Without analyzing your annuity I cant say for certain but your current annuity may offer better terms than the Jackson Perspective II.

E elects to receive annual distributions from Plan X in the form of a 27 year period certain annuity ie a 27 year annuity payment period without a life contingency paid at a rate of 37000 per year beginning in 2005 with future payments increasing at a rate of 4 percent per year ie the 2006 payment will be 38480 the 2007 payment. Certain taxpayers affected by a federally declared disaster that occurs after. Upon the death of the annuitant a period certain annuity will continue providing income payments to a beneficiary named in the contract.

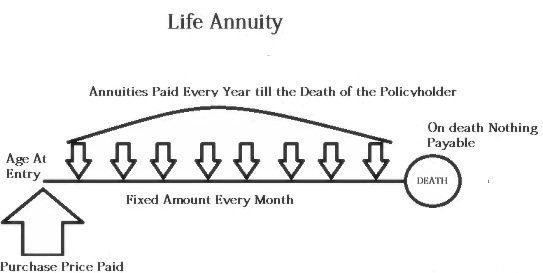

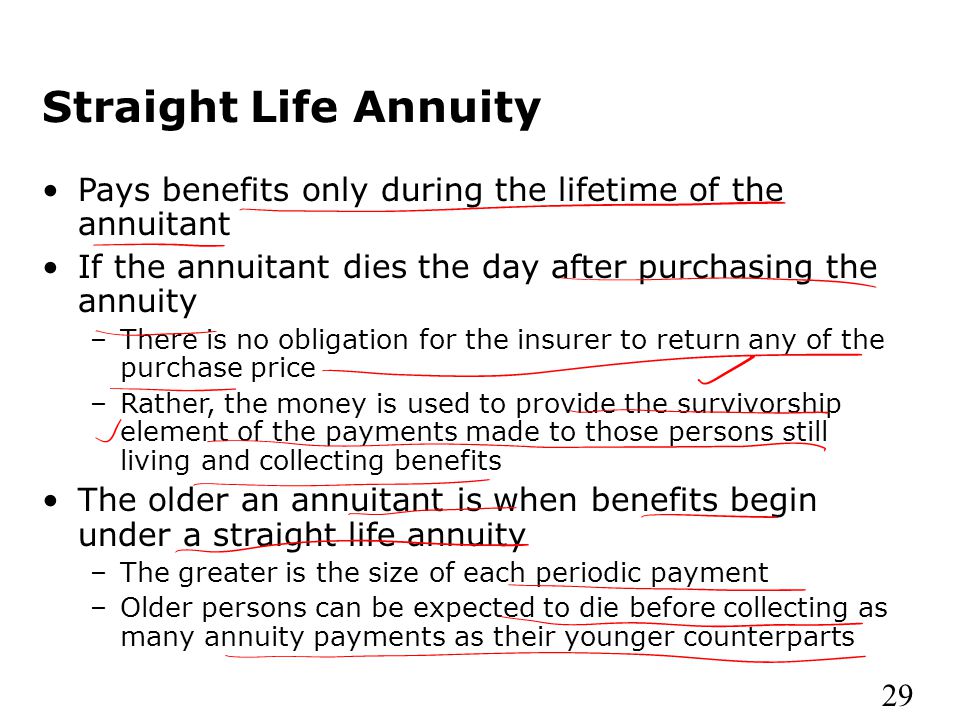

Period certain annuities are similar to straight-life annuities but they include a minimum time period for the payments say 10 or 20 years even if the annuitant dies. Standby cash for the family and you into the best years ahead. Life Insurance Cash benefits for your family in case of death.

For single employees the required form of payment is a straight-life annuity which typically provides a monthly payment based on the plan formula. You can manipulate your term from three to 40 years and most are highly flexible. Best Term Certain.

Term-certain annuities are usually the one I prefer. For this reason income payments will. Sell all or part of your Annuity or Structured Settlement payments.

For this annuity over a 30 year period the returns a 60 stocks and 40 bonds portfolio might experience after fees are likely to be in the range of 2 to 35 for the income rider only and 3 to 5. A period certain option added to a straight-life or joint and survivor annuity means the insurance company must continue making payments after the death of the annuitant.

Joint And Survivor Annuity The Benefits And Disadvantages

How A Single Life Annuity Will Impact Your Retirement Due

When Can You Cash Out An Annuity Getting Money From An Annuity

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Straight Life Annuity Providing Peace Of Mind In Your Retirement

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

What Is A Life Annuity With Period Certain Trusted Choice

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Annuities And Individual Retirement Accounts Ppt Video Online Download

Period Certain Annuity What It Is Benefits And Drawbacks

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download